Why is there so much paperwork needed for my Mortgage Application?!?!

I hate paperwork as much as anyone, but when it comes to the paperwork required for a mortgage application, there is no way around it! Mortgage lending is becoming tighter and tighter with regards to lending risk, government regulations and guidelines set out by each lender. As with any investment, lending mortgage funds is a risk/reward … Read more

What to Expect When Purchasing a Home!

Check out my infographic on what to expect when purchasing your new home!

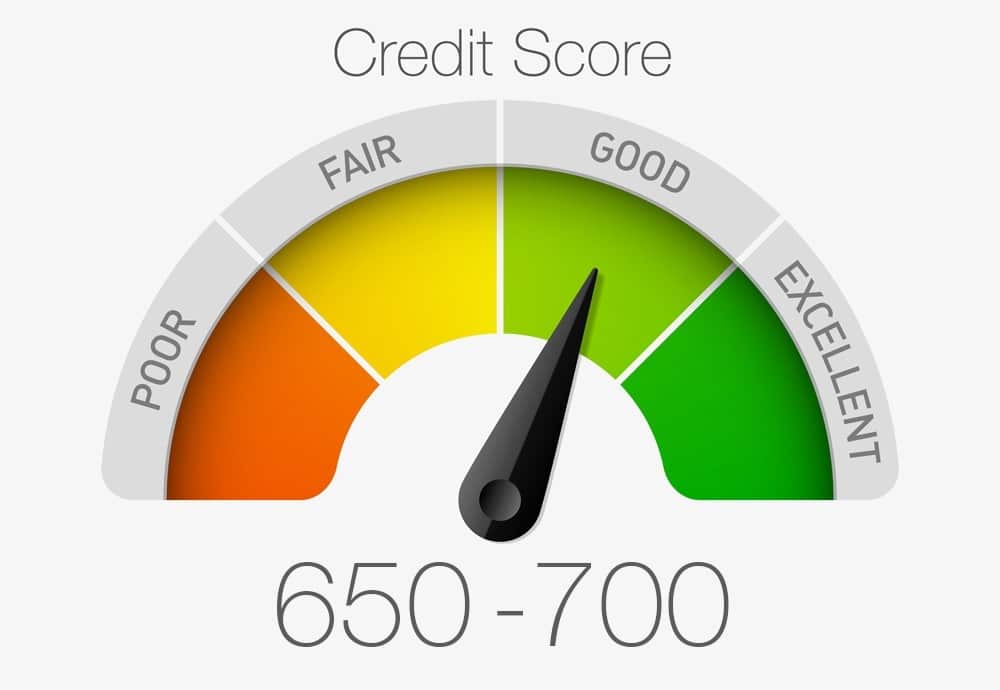

There’s more to it than just a Credit Score!

There is more to just a number when it comes to your credit score. With regards to mortgages, lenders will not only consider the score itself, but they’ll also look at the payment history, outstanding balances, minimum monthly payments, how many sources of credit are on the report, and the length of each credit account. At … Read more

Why spend the time to get a mortgage pre-approval? I’ll tell you why!

I’ve had many people ask why they should get a mortgage pre-qualification or pre-approval BEFORE starting the search for their dream home. But first – what is the difference between a pre-qualification or pre-approval? Let me explain. I use a mortgage pre-qualification to let my clients know what they should be able to afford based on their household … Read more

Enter to Win A London Wine and Food Show Package!

What a better way to bring in the new year than by winning a London Wine and Food Show Package! Win entry into one of London’s most popular events of the year! Simply connect with Spencer Murray Mortgages on Social Media to enter, winner will be chosen by Thursday January 18th at 7pm. Any one of … Read more

New Mortgage Rules: For Better or For Worse?

Given the recent introductions of new rules proposed by the government – I am compelled to write a post on how these changes are going to affect any homebuyers, especially those who have worked hard to save their hard-earned money, or current home equity, for a 20% down payment on their next purchase. For those … Read more

Buyer Beware – Purchasing a Home in an Inflated Housing Market

As the real estate market begins to cool down after an intense first half of 2017, here are a few points to consider when it comes to purchasing a home with inflated purchase prices. Mortgage Lending Lenders will only fund mortgages based on the purchase price or value of the home, whichever is lower. That being … Read more

Here is a Mortgage Need to Know! Variable vs. Fixed Rate Mortgages

When it comes to mortgages, one of the most important conversations I have to have with my clients is whether to choose between a variable or a fixed interest rate. It raises the common question – which is better? Each has their own advantages and disadvantages. Do you choose a bit of risk when it … Read more

Mortgages 101: Basic Terminology

This article is meant to inform you on the basic mortgage terms I use in my day-to-day work environment. Conventional Mortgage (Uninsured) The mortgage amount does not exceed 80% of the property’s value. Therefore, purchaser is supplying a minimum of 20% of the purchase price as a down payment. Hi-Ratio (Insured) The mortgage amount exceeds … Read more

Purchase Plus Improvements

Does the home you are purchasing require upgrades or renovations? Will a new roof, central air, a new furnace, upgrades to the electrical or plumbing system, new doors, windows, a new kitchen or bathroom, or any other renovation increase the value of the home? With a Purchase Plus Improvements mortgage product you can add the … Read more