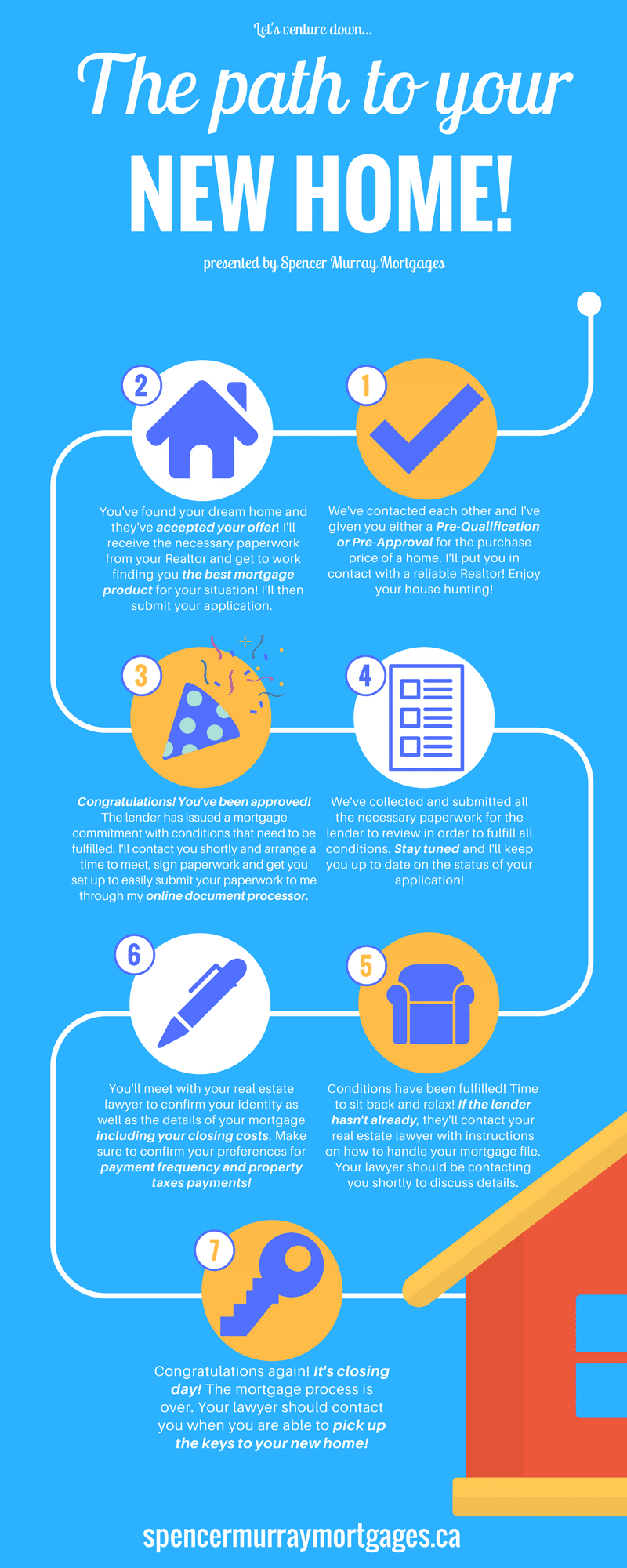

Heed some advice on how to best set yourself up to maximize the mortgage and purchase price you are able to afford as a buyer!

When working on applications for clients, I need to take two debt servicing ratios into account. One is called the Gross Debt Servicing Ratio and the other is the Total Debt Servicing Ratio.

Your GDS is a ratio based on what would potentially be your mortgage payment + property taxes + heat on a monthly basis relative to your income amount. For qualifying purposes heat can range from $75 to $100/month depending on the property – this is not your actual heating cost per month. Typically, this ratio cannot exceed 39% (that means mortgage payment + property taxes + heat cannot exceed 39% of your income).

Your TDS is a ratio similar to GDS only it also takes your monthly debts into consideration (mortgage payment + property taxes + heat + debts) relative to your income. In most cases, this ratio cannot exceed 44% (that means mortgage payment + property taxes + heat + debts cannot exceed 44% of your income).

For qualifying purposes – a couple years ago, the government introduced a mortgage qualifying rate. For most mortgages to qualify, they have to be qualified at either the Benchmark Qualifying Rate or the Contract Rate (the rate I can get you) plus 2%, depending on the mortgage type and the lender. This qualifying rate is not the rate you pay, but the rate I would have to qualify you at. It’s unfortunate because it lowers the amount of the purchase price for home buyers by about 20%.

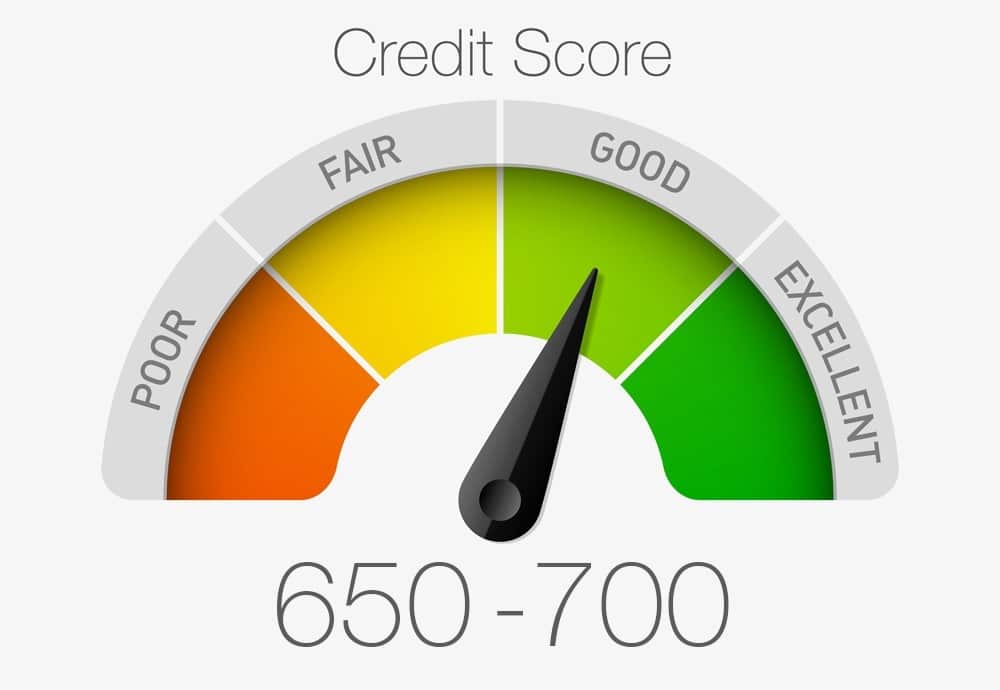

There are many moving parts when it comes to a mortgage pre-approval. Income, down payment amounts, current debts obligations and future debts obligations all play a major factor in the pre-approved purchase amount. Your credit score and history also sit closely on the back-burner ready to cause chaos should your score come in low. Each of these factors can be broken down further into smaller variables as well.

The most common roadblock I run into with clients, aside from everyone wishing they made more money, is current debt obligations – more specifically, car debts!Although you may be able to afford that ~$500/month car payment on paper without breaking the bank, it really dampens the mood when you want the most out of your home buying experience.

Let’s put this into perspective. Based on the ratios above, your overall monthly debt expenses cannot exceed 5% of your monthly overall income, that is – if we’re looking to maximize your affordability for a home. My advice if you’re looking to purchase a home – WORK YOUR ASS OFF! Short-term pain for long-term gain. Not only does this look better on paper for your application, it’ll help you pay off those debts, save more for your down payment and sweeten the reward once you move into your new home.

In sum, if you maximize your income earnings, minimize your monthly debts, save for a higher down payment and utilize your credit appropriately you’ll be able to confidently put in an offer on a home in this seemingly endless hot housing market!