I hate paperwork as much as anyone, but when it comes to the paperwork required for a mortgage application, there is no way around it!

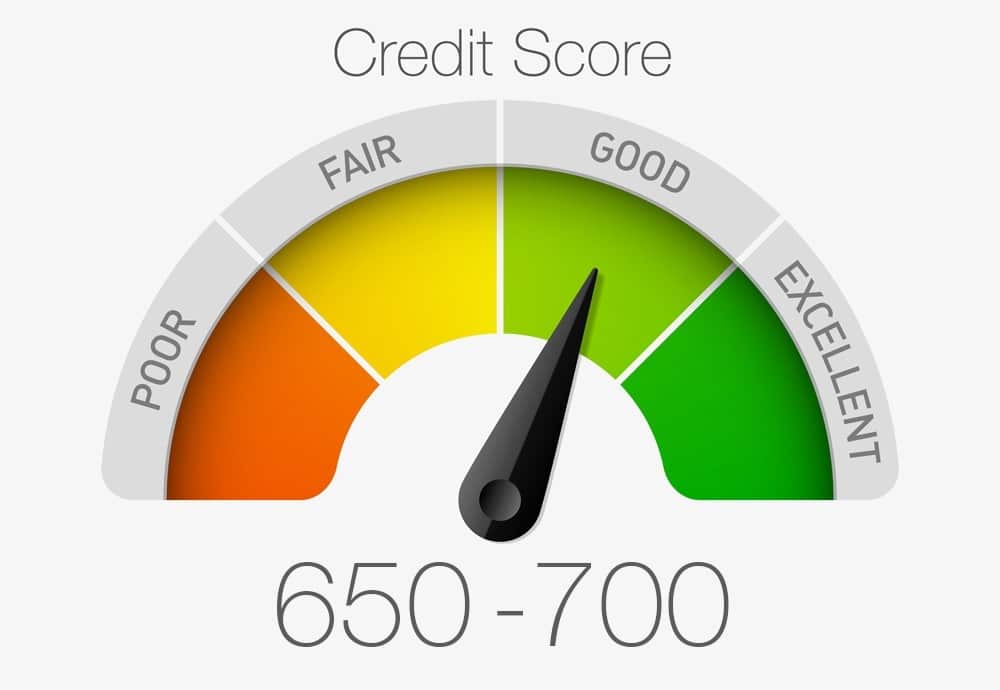

Mortgage lending is becoming tighter and tighter with regards to lending risk, government regulations and guidelines set out by each lender. As with any investment, lending mortgage funds is a risk/reward scenario for the lender. For the borrower – the riskier they are to lend to, the higher their interest rate will be. Why are even the best applicants – individuals with good employment, good credit, minimal debts and a reasonable down payment – still subject to all this paperwork? Below are the various categories for which paperwork is required.

Income:

Lenders will always want to see a recent employment letter, recent pay-stub and the previous year’s T4 to prove income. If you’re self employed, they’ll want to see even more – your last 2 year’s T1 General Forms and Notice of Assessments (NOAs), business license/articles of incorporation, and possibly your statement of business activities or business’ financial statements. They need all these documents as proof on multiple fronts that your income is as stated in the application. Many of these lenders are requiring these income documents upfront – meaning when the application is submitted. My advice to you – FILE YOUR TAXES!

Down Payment and Closing Costs:

This also tends to be a paperwork nightmare. Most lenders require anywhere from 30–90 days of transactional banking history showing proof of down payment and closing costs when purchasing a home. I can’t stress enough – this is a must and cannot be avoided! Reason being – regulations set out by FINTRAC (Financial Transactions and Reports Analysis Centre of Canada) and OSFI (Office of the Superintendent of Financial Institutions) with regards to anti-money laundering and compliance. The lenders will question any abnormal, large deposits going into the bank accounts supplied to them. If there are any large deposits showing, be prepared to show where the money came from (either a relative’s bank account, or the receipt from the sale of a personal item etc.).

Other:

- Current Mortgage Statement and Property Tax Statement – if you currently own a home

- Signed Agreement of Purchase and Sale plus the MLS Listing – typically supplied by your Realtor

- Statements of debts to be paid out or proof they’ve been paid off – lenders will require to ensure the debt ratios are still in line

- Separation/Divorce/Child Support Agreements – this is for the lender to ensure agreed upon payments are being received or paid out on a recurring basis

Every mortgage is different. Every lender has different requirements. I’ve gone over the most popular paperwork that is needed by most lenders but if you’re applying for a mortgage, the lender may require more than what I’ve listed above.

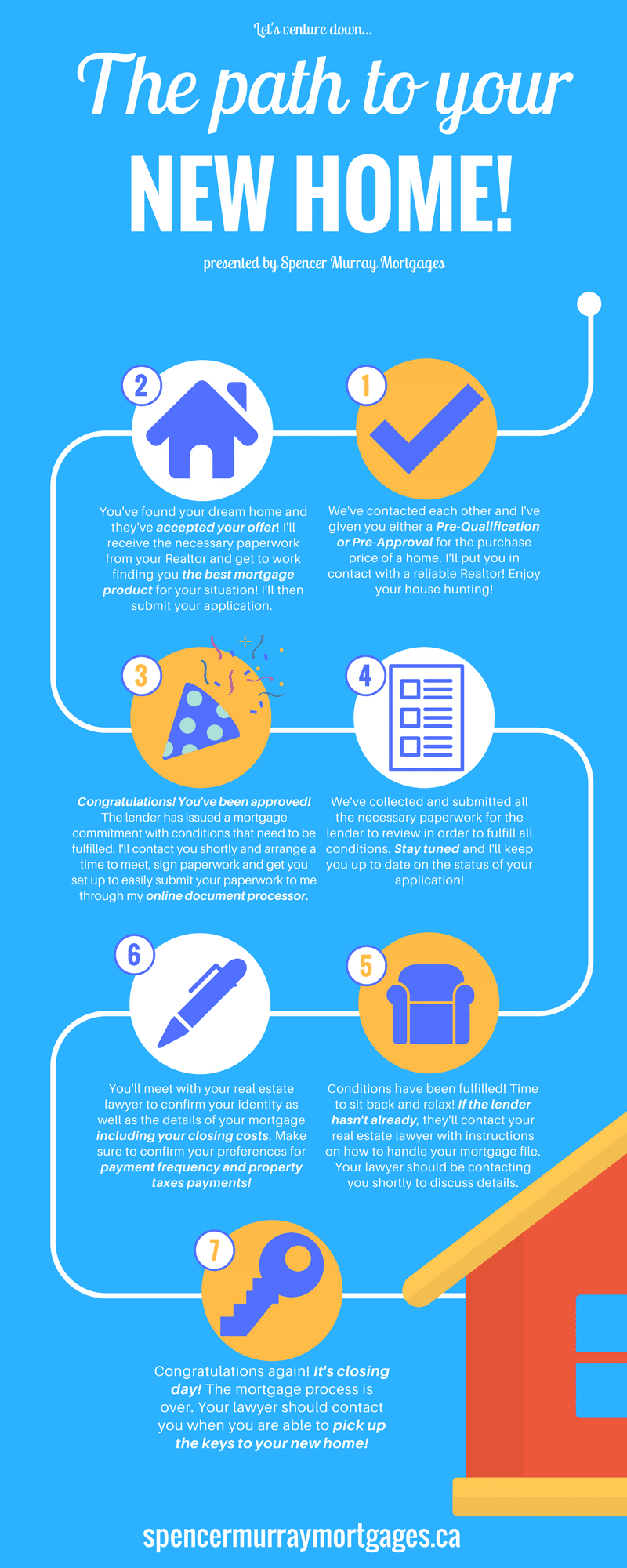

When giving clients a pre-approval for a mortgage, I can only work with the information I have been given. If there are missing pieces to the puzzle, I can’t supply them with the whole picture. Pre-approvals can be fast, if you’re prepared.

I have come to use an online resource called Floify to manage most of the paperwork when dealing with clients’ applications. Not only does it save us trees, but the user friendly interface makes it incredibly easy for my clients to upload the specific paperwork I need to submit an application.